Remainder Interest with $ 0 no down payment

A remainder interest vests when the life estate or term of years concludes, transferring full ownership rights to the holder of the remainder interest. When purchasing a remainder interest, the buyer acquires a future interest, meaning they have no immediate possession until the end of the life estate or term. The value of this interest at the time of purchase is determined using IRS actuarial tables, which calculate the present value based on the life expectancy of the life tenant or the duration of the term. These tables consider factors such as the age of the life tenant or the fixed term length, providing an accurate estimate of the remainder interest's value. Purchasing a remainder interest is often much less expensive than the current fair market value (FMV) of the property because it reflects the delayed possession and associated risks. The discount arises because the buyer must wait, sometimes for an extended period, before obtaining full ownership rights. This reduced price can be advantageous for those looking to acquire property at a lower cost for estate planning or investment purposes. Upon the termination of the life estate or term of years, the buyer’s remainder interest fully vests, converting into a possessory interest and granting them full ownership of the property.

List of Benefits and Features of Seller & Buyer, with a $ 0 no down payments, a Remainder Interest with lower capital gains taxes

ChatGPT said:

Selling and buying a remainder interest with $0 no down payment offers significant benefits and features for both the seller and the buyer, particularly when aiming to reduce capital gains taxes. This strategic transaction structure can provide immediate liquidity, tax advantages, and long-term investment opportunities. Below are the detailed benefits and features for each party:

Benefits for the Seller:

- Immediate Liquidity:

- The seller can receive funds from the sale of the remainder interest without relinquishing the full control or use of the asset during their lifetime or for a specified term. This provides immediate cash flow while still benefiting from the asset.

- Reduced Capital Gains Taxes:

- By selling only the remainder interest, the taxable gain is based on the present value of the remainder interest, which is generally lower than the entire asset’s value. This reduces the overall capital gains taxes the seller owes.

- Additional tax benefits may be available if the seller uses a charitable remainder trust or other tax-advantaged structures to complete the sale.

- Retention of Income and Use:

- The seller retains the right to use the asset, receive income from it (e.g., rental income, business profits), and manage it during the life estate period. This ensures ongoing financial stability and control.

- The seller remains in charge of operational and management decisions, allowing them to maintain control over the asset's value and performance until the remainder interest takes effect.

- Seller Financing and Interest

Income:

- Offering seller financing allows the seller to spread out payments over time, potentially earning interest on the financed amount. This can create an additional income stream for the seller, enhancing the overall financial return from the transaction.

- Flexible payment terms, such as interest-only periods or deferred payments, allow the seller to structure payments in a way that maximizes their financial benefits.

- Estate Planning Advantages:

- Transferring the remainder interest can remove the asset from the seller’s taxable estate, reducing estate taxes and simplifying the transfer of wealth to heirs or beneficiaries. This is particularly advantageous for high-value assets where estate tax exposure is a concern.

- The seller retains a life estate, which offers control and security over the asset while planning for a tax-efficient transition.

Benefits for the Buyer:

- Acquisition with Minimal Upfront

Investment:

- Buyers can acquire the remainder interest with $0 down using seller financing or other creative financing options. This minimizes the initial capital needed, making it an attractive option for buyers seeking to maximize their investment potential without significant upfront costs.

- Financing structures, such as deferred payments or income-based repayments, allow buyers to use future income generated by the asset to fund the purchase, making the acquisition more financially manageable.

- Discounted Purchase Price:

- The price of a remainder interest is typically discounted compared to purchasing full ownership because the buyer’s control is deferred. This provides an opportunity to acquire assets at a lower cost, making it a cost-effective investment strategy.

- The valuation of the remainder interest reflects the deferred ownership and use, allowing buyers to secure valuable assets at a lower entry point.

- Long-Term Investment Potential:

- Buyers gain future ownership of the asset, potentially benefiting from its appreciation over time. When the remainder interest becomes active, the buyer gains full control, which may include revenue streams, business operations, or property management.

- For assets with high potential for appreciation (e.g., real estate, businesses), this structure allows buyers to invest strategically with minimal initial financial commitment.

- Tax Efficiency and Deductions:

- Acquiring a remainder interest may offer tax advantages, especially if structured through tax-efficient entities or charitable arrangements. Buyers may benefit from deductions or deferred tax liabilities, depending on the specifics of the transaction.

- Buyers can strategically plan for future depreciation benefits and other deductions once they gain full ownership of the asset, further optimizing the long-term tax impact.

- Flexible Payment Structures:

- Buyers can negotiate flexible terms with the seller, such as interest-only payments, revenue-based repayments, or balloon payments. This provides buyers with the flexibility to manage payments based on the asset’s income potential or other financial arrangements.

- This flexibility makes it easier for buyers to manage cash flow and secure valuable assets with minimal financial risk.

Features of a Remainder Interest Transaction with $0 Down:

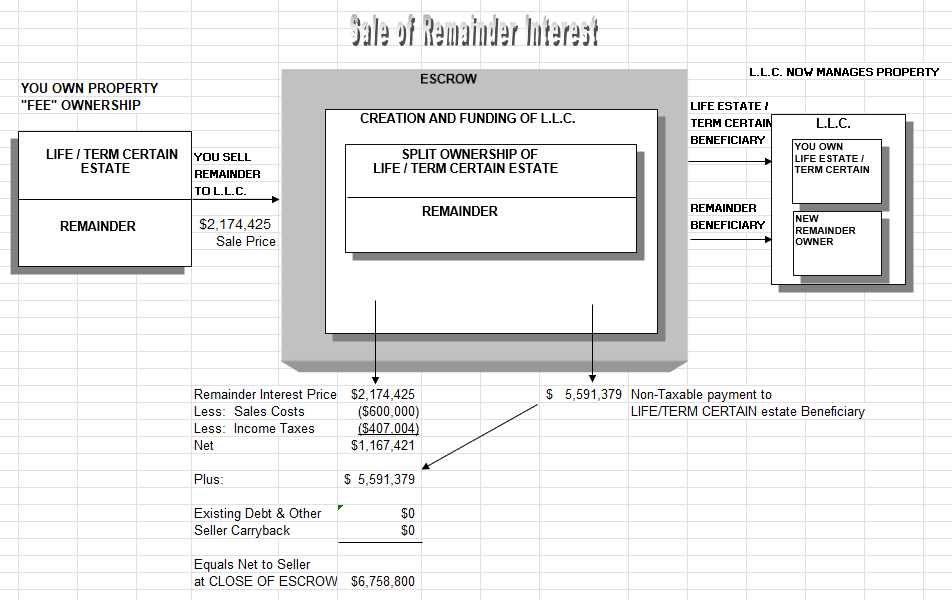

- Split Ownership Structure:

- The transaction divides ownership into two components: a life estate (retained by the seller) and a remainder interest (acquired by the buyer). This split allows the seller to maintain control and benefit from the asset during their lifetime or a specified term, while the buyer secures future ownership rights.

- This structure offers a flexible and balanced approach that serves the financial and tax needs of both parties.

- Valuation Based on Actuarial or

Market Calculations:

- The value of the remainder interest is calculated based on actuarial tables (considering the seller’s life expectancy) or market-based factors (e.g., projected income, business growth). This valuation approach typically results in a lower price for the remainder interest, benefiting both parties.

- Professional valuation ensures that the transaction is fair and compliant with tax regulations, optimizing the financial outcome for both seller and buyer.

- Customizable Financing and Payment

Terms:

- The transaction supports various financing options, such as seller financing, private loans, and deferred payment agreements, allowing the buyer to acquire the remainder interest with $0 down. These flexible financing terms are designed to accommodate both the seller’s and buyer’s financial goals.

- Payments can be structured to align with the asset’s revenue generation or the buyer’s cash flow situation, making the acquisition more sustainable.

- Control Over Income and Management:

- The seller retains the right to income and control over the asset during the life estate period, ensuring they can continue to benefit financially and operationally until the remainder interest becomes active.

- The buyer gains future rights to manage and benefit from the asset, with the assurance that they will assume full ownership at a predetermined time.

- Tax and Estate Planning

Opportunities:

- For sellers, transferring the remainder interest may reduce the overall value of their taxable estate, lowering estate taxes. This feature is especially beneficial for high-value assets where estate tax planning is crucial.

- Buyers can incorporate the remainder interest acquisition into broader estate planning strategies, ensuring that future wealth and assets are managed tax-efficiently and aligned with their long-term goals.

Conclusion:

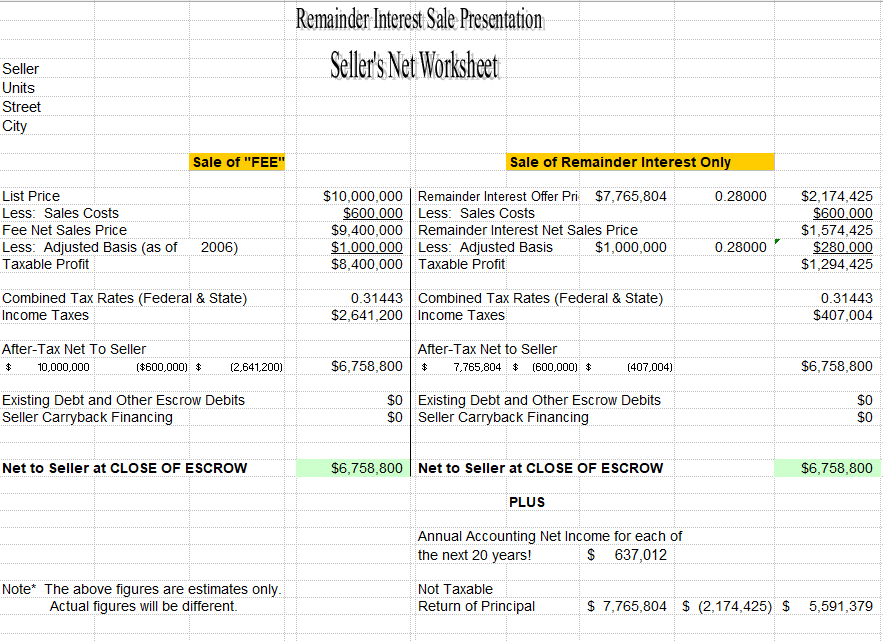

Selling and buying a remainder interest with $0 down offers multiple financial, tax, and strategic benefits. The seller gains liquidity, reduced capital gains taxes, and the ability to retain income, while the buyer acquires future ownership with minimal initial investment and significant tax advantages. Proper structuring and professional advice are crucial to ensuring that both parties maximize these benefits while maintaining compliance with legal and tax requirements.Sale of Real Estate Remainder Interest Presentation

1. We have the $ 0 no down payment algorithms available to the Seller Á Buyer Explanations.

-

- Worksheet for $ 0 no down payment - Real Estate available.

- Worksheet for $ 0 no down payment - Personal Property available.

- Worksheet for $ 0 no down payment - Business available.

How to "Hold" Remainder Interest

What legal "person" entity should be created to hold remainder of a "non-family" seller of a Remainder Interest

ChatGPT said:

When a "non-family" seller sells a remainder interest, the buyer (or the entity acquiring the remainder interest) should establish a legal entity that provides flexibility, liability protection, tax advantages, and efficient management. Here are the most suitable legal "person" entities to hold the remainder interest, especially when dealing with non-family transactions:

1. Limited Liability Company (LLC):

- Benefits:

- An LLC offers flexibility and liability protection, making it a suitable choice for holding remainder interests. The LLC structure shields the owners (members) from personal liability associated with the property.

- LLCs can be used to manage a wide variety of assets, such as commercial real estate, rental properties, and other income-generating properties, efficiently and professionally.

- It allows for flexible management and ownership structures, accommodating non-family investors, partners, or multiple stakeholders.

- Tax benefits can include pass-through taxation, which means profits and losses are reported on the members' tax returns, avoiding double taxation.

- When to Use:

- When the remainder interest involves commercial properties, rental properties, or other income-generating assets where professional management is required.

- Suitable for investment groups or partnerships seeking to acquire and manage remainder interests with clear governance and liability protection.

2. Corporation (C-Corp or S-Corp):

- Benefits:

- Corporations provide a higher level of formality and are suitable for more complex or larger-scale transactions. They can shield shareholders from personal liability and are effective for holding high-value remainder interests.

- An S-Corporation may be advantageous if the owners want the entity to have pass-through taxation like an LLC, as long as it meets IRS requirements. This avoids double taxation while retaining corporate structure benefits.

- A C-Corporation could be used if the goal is to raise capital from investors, issue shares, or reinvest profits into acquiring more remainder interests or other assets.

- When to Use:

- When the buyer is part of a larger investment group or company that seeks to acquire and manage multiple remainder interests.

- When the intent is to build a portfolio of remainder interests and possibly offer shares or ownership stakes to outside investors.

3. Trusts:

- Irrevocable Trust:

- An irrevocable trust can be used to hold the remainder interest, providing asset protection, tax planning, and estate planning benefits.

- Once the remainder interest is transferred into the trust, it is protected from creditors and legal claims, and it may also help reduce the grantor’s taxable estate if structured properly.

- Charitable Remainder Trust (CRT):

- If the buyer is a charitable organization or wishes to establish a charitable purpose, a CRT can be an effective way to acquire and manage the remainder interest.

- The seller can receive income for life or for a specific term, after which the remainder interest is transferred to the charity. This structure offers significant tax benefits, including income tax deductions and capital gains tax deferral.

- The CRT is beneficial when combining philanthropic goals with investment in remainder interests.

- When to Use:

- For charitable organizations or entities looking to integrate philanthropic objectives with remainder interest investments.

- When asset protection and estate planning are top priorities, especially for non-profit or charitable endeavors.

4. Family Limited Partnership (FLP) (even if not directly family-related):

- FLPs can be used strategically even if the parties are not related. They are often structured to hold and manage real estate assets efficiently, with clear rules for transferring ownership.

- The general partner (which could be an LLC or another entity) has control over the partnership, while limited partners (investors or other stakeholders) have ownership shares without management responsibilities.

- This structure can offer both tax advantages and liability protection while allowing for flexibility in management and transfer of interests.

- When to Use:

- When multiple non-family partners are involved, and there is a need for a clear division of control and ownership.

- In situations where the asset involves real estate or income-producing properties requiring shared ownership and structured management.

5. Real Estate Investment Trust (REIT):

- For larger-scale acquisitions of remainder interests in commercial real estate or rental properties, establishing a REIT can be an effective strategy.

- A REIT allows the entity to pool funds from multiple investors, providing the capital needed for remainder interest acquisitions. It offers significant tax benefits if the REIT meets IRS requirements, such as distributing 90% of its taxable income to shareholders.

- The REIT structure also provides liquidity options for investors, as shares can be sold or traded, unlike other legal structures.

- When to Use:

- When the intent is to create a diversified portfolio of remainder interests in commercial or rental properties and to raise capital from multiple investors.

- For institutional buyers or investment groups looking to manage and grow their real estate portfolios professionally.

Summary:

Best Entity Recommendations Based on Scenarios:

- LLC: Most flexible and suitable for individual investors, small groups, or companies acquiring remainder interests in real estate or businesses.

- Corporation (S-Corp or C-Corp): Suitable for larger organizations or investment groups looking to manage multiple remainder interests.

- Trusts (Irrevocable or Charitable Remainder Trust): Ideal for asset protection, tax planning, or charitable endeavors.

- FLP: Useful when structuring shared ownership among non-family partners, particularly for real estate.

- REIT: Best for institutional or large-scale investments focusing on remainder interests in commercial or income-producing properties.