Remainder Interest Business

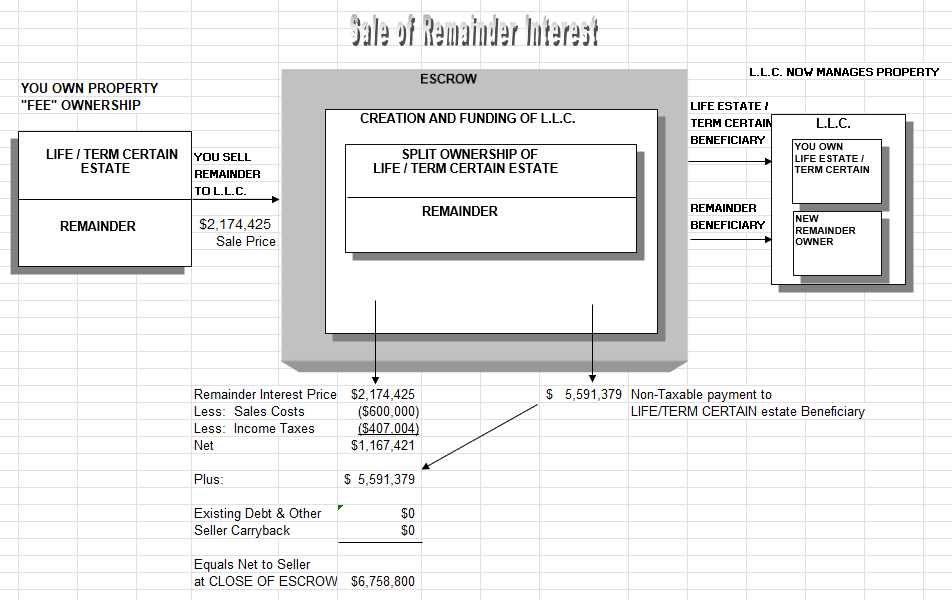

A remainder interest vests when the life estate or term of years concludes, transferring full ownership rights to the holder of the remainder interest. When purchasing a remainder interest, the buyer acquires a future interest, meaning they have no immediate possession until the end of the life estate or term. The value of this interest at the time of purchase is determined using IRS actuarial tables, which calculate the present value based on the life expectancy of the life tenant or the duration of the term. These tables consider factors such as the age of the life tenant or the fixed term length, providing an accurate estimate of the remainder interest's value. Purchasing a remainder interest is often much less expensive than the current fair market value (FMV) of the property because it reflects the delayed possession and associated risks. The discount arises because the buyer must wait, sometimes for an extended period, before obtaining full ownership rights. This reduced price can be advantageous for those looking to acquire property at a lower cost for estate planning or investment purposes. Upon the termination of the life estate or term of years, the buyer’s remainder interest fully vests, converting into a possessory interest and granting them full ownership of the property.

With financing qualified: Can a "Buyer" for acquiring a "U.S. Business" or for a "Remainder Interest" with $ 0 down with Seller entity as a Individual, Corporation, Partnership or Trust with a net sales proceeds comparing a Sale Fee Interest with a Remainder Interest

ChatGPT said:

Yes, a buyer can potentially acquire a U.S. business or a remainder interest in a business with $0 down, provided that financing is properly structured and secured. Below is an explanation of how such transactions could work and a comparison of the net sales proceeds between selling a business as a fee interest (full ownership) versus selling a remainder interest. This analysis considers various seller entities, including individuals, corporations, partnerships, or trusts.

How a $0 Down Remainder Interest Acquisition Might Work:

- Financing Arrangement:

- The buyer may secure financing through traditional lenders, investors, or seller financing. In a $0 down structure, the financing could be structured to cover the entire purchase price of the remainder interest, allowing the buyer to acquire it without upfront payment.

- The financing could involve deferred payment terms, revenue-based repayments, or other creative structures like profit-sharing or equity arrangements, enabling the buyer to manage costs using the business’s future cash flow or profits.

- Seller Financing Options:

- The seller (whether an individual, corporation, partnership, or trust) might offer financing directly to the buyer. The seller could agree to a payment plan based on business performance or future earnings. Such agreements could include interest-only periods, balloon payments, or even equity stakes as part of the payment, reducing the buyer's initial cash requirement to zero.

- Seller financing can be particularly attractive when the seller wants to maintain an interest in the business’s future success while providing an incentive for the buyer to grow and optimize the business.

Comparison of Net Sales Proceeds: Fee Simple Sale vs. Remainder Interest Sale for a U.S. Business

|

Aspect |

Fee Simple Sale |

Remainder Interest Sale |

|

Sales Price |

Full market value of the business |

Discounted value based on actuarial or market factors for the remainder interest. |

|

Upfront |

Full payment received at closing |

A lower cash amount upfront; future cash flow may supplement or exceed this. |

|

Business Control |

The seller loses all control and management rights after the sale. |

The seller retains management rights and benefits until the remainder interest takes effect. |

|

Capital |

Full capital gains taxes are due on the total sale price, potentially at a higher rate. |

Reduced capital gains taxes, as only the remainder interest value is subject to tax, potentially lowering the tax burden. |

|

Ongoing Earnings |

The seller loses all rights to future earnings and business growth potential. |

The seller retains a right to earnings, dividends, or other income generated by the business until the remainder interest becomes effective. |

|

Flexibility |

No flexibility; ownership is transferred fully. |

The seller retains flexibility to make strategic decisions, including further structuring or refinancing the remainder interest. |

|

Estate Impact |

Removes the business from the seller’s estate, potentially reducing estate taxes. |

The remainder interest is out of the estate, but the retained interest (life estate) may still affect estate tax planning. |

|

Potential |

Deductions are limited to transaction-related expenses and business expenses. |

Possible tax deductions if the remainder interest is structured within a charitable or tax-efficient entity. |

Key Considerations for Structuring the Transaction:

- Valuation of the Remainder

Interest:

- Valuing the remainder interest for a business is often more complex than for real estate or personal property. The value could be based on the business's projected cash flow, profitability, and expected growth rate over the life of the seller’s retained interest. The discount applied reflects these factors, as well as market risks and the expected term of the seller’s involvement.

- For entities like corporations or partnerships, professional valuation and actuarial analysis may be necessary to determine a fair price for the remainder interest.

- Seller’s Financial Outcome:

- Fee Simple Sale: The seller receives the full market value immediately but loses any future control and potential for additional business growth. This is suitable if the seller wants to exit the business entirely and maximize immediate liquidity.

- Remainder Interest Sale: The seller receives a discounted amount initially (as the remainder interest reflects the future transfer of control). However, they can continue to earn income, manage the business, and benefit from any growth during the life estate period. This option is beneficial for sellers who want liquidity but still believe in the business’s future potential.

- Buyer’s Position:

- By acquiring the remainder interest with $0 down, the buyer gains the future right to control and profit from the business without needing significant upfront capital. Financing options, like revenue-based repayments or deferred payment structures, make this viable for buyers who see long-term potential in the business but lack immediate liquidity.

- Non-family buyers, such as investment firms or strategic partners, may be more inclined to structure such deals, as they often seek long-term value with minimal initial outlay, especially when the seller provides favorable financing terms.

- Financing Feasibility:

- For financing to be qualified with $0 down, lenders (or the seller) need confidence in the business’s financial health and future earnings potential. This is especially relevant for businesses with strong cash flow, established client bases, or a proven track record of profitability.

- Non-traditional financing routes, like private equity or venture debt, may be used, especially if the business has growth potential that justifies such investments.

- Legal and Tax Structure

Considerations:

- When the seller is a corporation, partnership, or trust, the transaction must align with the entity’s objectives and compliance requirements, including considerations for corporate tax, partnership agreements, or trust management rules.

- Sellers may choose to structure the remainder interest through vehicles such as Charitable Remainder Trusts (CRTs) or Family Limited Partnerships (FLPs) for additional tax efficiency and flexibility in estate planning.

Conclusion:

Selling a U.S. business or a remainder interest in the business with $0 down financing can be mutually beneficial if structured properly:

- Sellers can achieve immediate liquidity while continuing to earn income from the business. This approach also provides an opportunity to reduce capital gains taxes and optimize the tax implications associated with business ownership.

- Buyers gain future control of the business at a discounted price, using minimal initial capital. Financing options like seller financing, revenue-based repayments, and investor partnerships make this approach feasible.

In both cases, professional financial, legal, and tax planning is essential to ensure the transaction is beneficial and compliant with applicable laws. The exact structure will vary depending on the seller's entity type (individual, corporation, partnership, or trust) and the specific business circumstances.

Sale of Real Estate Remainder Interest Presentation

1. We have the $ 0 no down payment algorithms available to the Seller Á Buyer Explanations.

-

- Worksheet for $ 0 no down payment - Real Estate available.

- Worksheet for $ 0 no down payment - Personal Property available.

- Worksheet for $ 0 no down payment - Business available.