Remainder Interest Personal Property

A remainder interest vests when the life estate or term of years concludes, transferring full ownership rights to the holder of the remainder interest. When purchasing a remainder interest, the buyer acquires a future interest, meaning they have no immediate possession until the end of the life estate or term. The value of this interest at the time of purchase is determined using IRS actuarial tables, which calculate the present value based on the life expectancy of the life tenant or the duration of the term. These tables consider factors such as the age of the life tenant or the fixed term length, providing an accurate estimate of the remainder interest's value. Purchasing a remainder interest is often much less expensive than the current fair market value (FMV) of the property because it reflects the delayed possession and associated risks. The discount arises because the buyer must wait, sometimes for an extended period, before obtaining full ownership rights. This reduced price can be advantageous for those looking to acquire property at a lower cost for estate planning or investment purposes. Upon the termination of the life estate or term of years, the buyer’s remainder interest fully vests, converting into a possessory interest and granting them full ownership of the property.

With financing qualified: Can a "Buyer" for acquiring a "Personalty" or "Personal Property" for a "Remainder Interest" with $ 0 down with Seller with a net sales proceeds comparing a Sale Fee Interest with a Remainder Interest

ChatGPT said:

Yes, a buyer can potentially acquire a "Personalty" (personal property) or "Personal Property" through a remainder interest with $0 down, using financing options that make the transaction viable for both parties. Here’s an overview of how this might work and a comparison of the net sales proceeds between selling a fee simple interest (full ownership) and selling a remainder interest.

How a $0 Down Remainder Interest Acquisition for Personal Property Might Work:

- Financing Arrangement:

- The buyer could secure financing through a lender, such as a personal loan or a loan secured against other assets, to acquire the remainder interest. In this scenario, the buyer does not put any money down upfront if the lender is willing to cover the entire amount, expecting repayment based on the value and future use of the personal property.

- Alternatively, the seller might provide financing directly. The seller, acting as the lender, may agree to a payment plan where the buyer pays off the remainder interest over time, using income generated from the property or other assets as collateral.

- Seller Financing with Flexible

Terms:

- In a $0 down arrangement, the seller may structure the financing with terms that make it feasible for the buyer, such as interest-only payments for an initial period or deferred principal payments. This allows the buyer to take possession of the remainder interest without upfront costs while committing to payments over time.

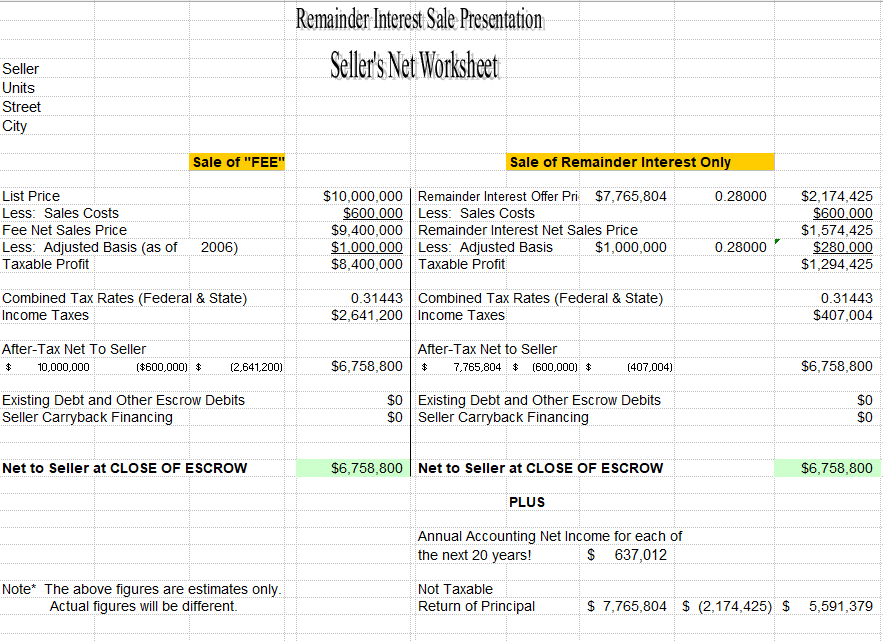

- Seller’s Net Proceeds Comparison:

Sale of Fee Simple Interest vs. Sale of Remainder Interest:

- Fee Simple Sale: The seller’s net proceeds are based on the full market value of the personal property at the time of sale. The seller receives the entire amount upfront (minus transaction costs) but loses all future rights to the property.

- Remainder Interest Sale: The seller receives an amount based on the value of the remainder interest, which is discounted according to actuarial calculations (if applicable) or based on an agreed formula considering the life expectancy or use duration. The seller retains the benefits and use of the property during their lifetime or the specified term.

Comparison: Net Sales Proceeds from Fee Simple Sale vs. Remainder Interest Sale for Personal Property

|

Aspect |

Fee Simple Sale |

Remainder Interest Sale |

|

Sales Price |

Full market value |

Discounted value based on the remainder interest (present value) |

|

Upfront |

Full amount paid at closing |

Lower cash amount upfront, as the remainder interest is valued based on future transfer |

|

Use and Benefits |

The seller loses all rights and benefits immediately |

The seller retains the right to use or benefit from the personal property during their lifetime or term |

|

Tax Impact |

Potentially higher taxes, depending on the gain realized |

Reduced tax impact, as only the remainder interest is taxed |

|

Ongoing Control |

No control after the sale; ownership fully transfers |

The seller retains control and use until the remainder interest takes effect |

|

Potential |

Limited, mostly focused on the sale |

Potential tax advantages if structured through charitable arrangements or other tax-efficient methods |

|

Future |

The seller no longer benefits from appreciation |

The seller continues to benefit from appreciation or depreciation of the property during their lifetime |

Considerations for Structuring the Transaction:

- Valuation of the Remainder

Interest:

- Personal property, unlike real estate, might be valued differently depending on its type (e.g., vehicles, art, collectibles). The valuation for a remainder interest may be based on the projected useful life of the property, the seller’s life expectancy (if applicable), or another fair market value determination.

- Seller’s Financial Outcome:

- Fee Simple Sale: The seller receives the full market value upfront but gives up any future value or use of the property. This option is beneficial if the seller needs immediate cash and no longer wants or needs the personal property.

- Remainder Interest Sale: The seller receives a reduced amount initially, as the value reflects the present worth of the remainder interest. However, the seller can still use or enjoy the personal property for the duration of their life or the specified term. This option benefits sellers who want immediate liquidity but also want to retain usage or enjoyment of the property.

- Buyer’s Position:

- Acquiring a remainder interest at a reduced cost, with $0 down financing, can be appealing to buyers who are willing to wait for full control. They gain eventual ownership at a discounted price and may structure the acquisition in a way that minimizes their upfront cash outlay.

- Financing Feasibility:

- For the buyer to qualify for $0 down financing, the lender (or the seller in a seller-financed deal) must be convinced of the future value and use potential of the property. Personal property like high-value equipment, vehicles, or collectibles may be easier to finance if they have a clear value and potential for appreciation.

- Professional Valuation and Legal

Structure:

- For both parties, having a clear, professionally determined value of the remainder interest is essential. Legal agreements must specify the terms, including the length of time the seller retains rights, the payment structure, and contingencies for the property’s condition or market fluctuations.

Conclusion:

Selling a remainder interest in personal property with $0 down financing can be a viable and mutually beneficial strategy:

- Sellers can receive immediate liquidity, reduced tax burdens, and retain control or use of the property for a defined period.

- Buyers acquire valuable property at a discounted rate with minimal initial investment, using creative financing strategies like seller financing or leveraging other assets.

This approach requires careful financial and legal planning to ensure the transaction benefits both parties and aligns with their respective goals and compliance requirements.

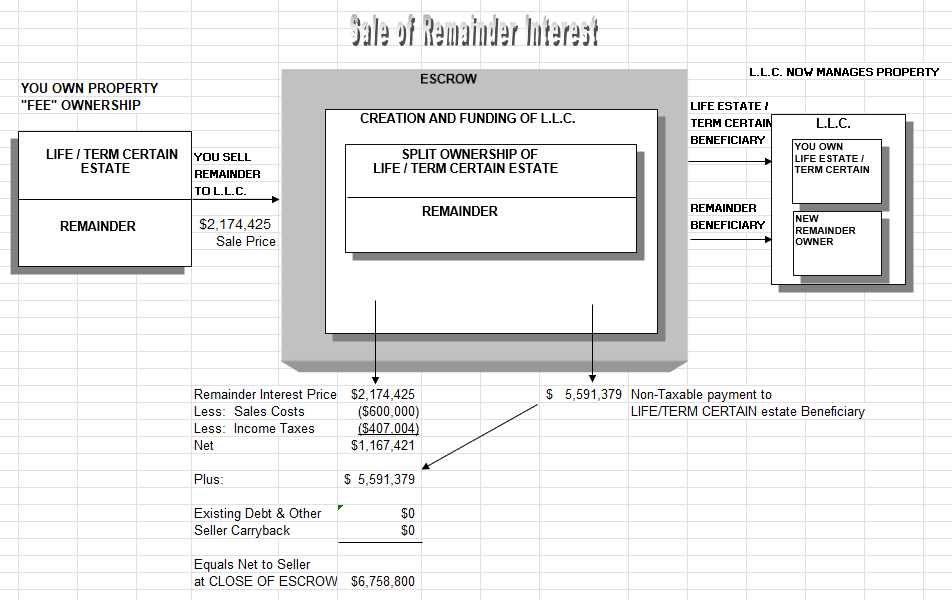

Sale of Real Estate Remainder Interest Presentation

1. We have the $ 0 no down payment algorithms available to the Seller Á Buyer Explanations.

-

- Worksheet for $ 0 no down payment - Real Estate available.

- Worksheet for $ 0 no down payment - Personal Property available.

- Worksheet for $ 0 no down payment - Business available.